What is happening with Starbucks stock market? Starbucks (NASDAQ: SBUX) goes back and forth with Wall Street investors, always trying to woo them and bring them on board no matter what the underlying trading or investing picture for the stock. Such wooing is par for the course and one can hardly blame SBUX for adopting such a posture. But on the other side of that posture are the analysts; an ever-parading wall of opinion on where SBUX will be at some point in the future. Their opinion is never cohesive, and for every analyst that considers Starbucks stock market upside

Category Archives: Day Trading

Is the stock market for kids? That’s a question that many day traders who trade penny stocks and who just happens to have kids may sometimes ask themselves. For some the stock market for kids idea is a bad one; but that’s only if the point of view assumes that your kids will never move into the grown-up world of adult finance. Chances are they will, so it is a good idea to educate them and have them believe in stock market for kids. Imagine for a second that you have a kid and have the parental ambition to steer

Stock market order types? Successful traders spend the time to get to know the stock market order types; without this knowledge traders have difficulty getting to grips with the market. Poor grip often translates into losses and a poor trading or investing experience. There are basically four types of stock market orders that can be placed: market order; limit order; stop loss; stop limit; trailing stop loss and trailing stop limit. Stock Market Order Types – Market Order A market order is an instruction to your broker to buy a set number of shares in a company at the prevailing

In 1987 one of the best stock market movie ever was released. That movie, dubbed appropriately, Wall Street, attempted to depict the internal workings of an almost ephemeral place that generations of people have flocked to in order to make a fortune. As a stock market movie Wall Street shines supreme and is today the standard-bearer for cinema as it relates to the often cut-throat world of trading in the stock market. Stock Market Movie – What Wall Street Got Wrong Wall Street tells the story of a young and ambitious stockbroker who manages to convince one of the top

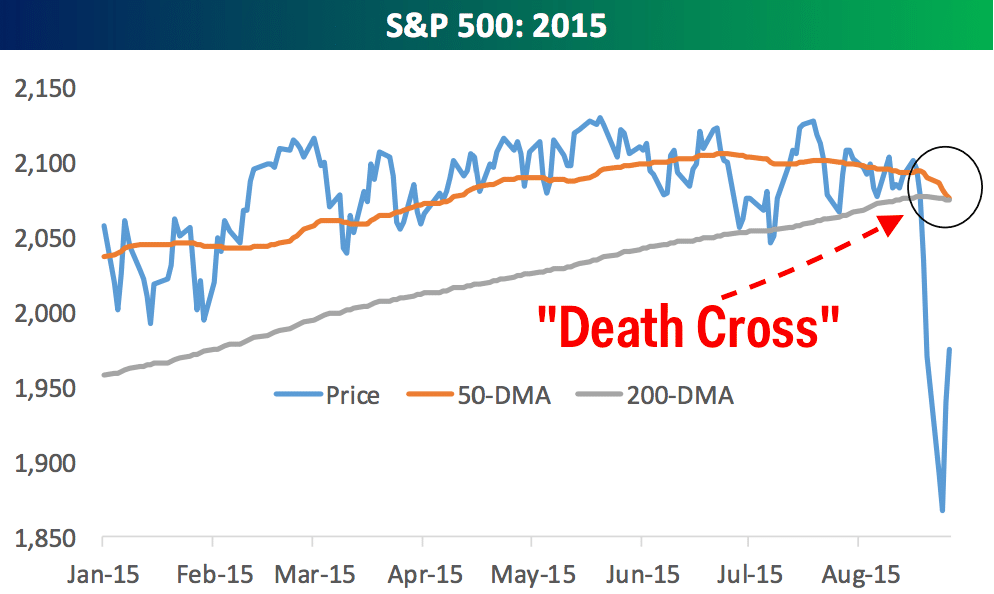

In order to understand the stock market death cross, there’s an important concept called a crossover which first has to be understood. Consider the crossover an essential foundation for reading a death cross – without this important charting event, no reading can take place. So what is a crossover? A crossover occurs when a security intersects one of its key technical indicators. The key indicators used to predict future movement of a stock vary, but the daily moving average continues to hold sway among traders and investors. An example of such a crossover would be when a security – i.e.

It’s not uncommon to hear a day trader or an investor proclaim that the stock market is rigged. They usually utter this notion after they’ve lost money, often despite following some well-worn advice about precisely how to play the stock market and win. From a rational perspective, suggesting that the stock market is rigged is no different from saying that the Golden State Warriors are winning because the NBA is rigged. No self-respecting NBA fan would say that because there is simply no evidence to support the claim. By the same token no evidence to prove that the stock market

There are quite a few good books written to show day traders and investors how to make money from the stock market but few hold a candle to how I made 2 million in the stock market. Written by Hungarian born Nicholas Darvas, the book how I made 2 million in the stock market has become one of the true stock market education classics. As a study in the fundamentals of how to play the stock market and win, you can scarcely find a better book – with an interesting backstory from the author to boot. How I Made 2

A big question that is trending among day traders who trade penny stocks is should I get out of the stock market? The answer to this question is pretty easy, but it depends on perspective. If you are day trader who hasn’t taken the time to get to grips with the stock market and penny stocks then clearly the answer to the question, should I get out of the stock market is a big fat YES. But that person would be what most Americans call a loser, a quitter, someone who doesn’t deserve to take part in the American dream.

Can a stock market board game make you rich? It’s a fascinating question – one many a day trader and investor asks often in a bid to find some solution to making money on the stock market. The reasoning behind the question is fair enough, too. Pilots spend hours in a simulated environment before taking to the skies to fly a plane; race car drivers now also undertake lots of simulated training before getting behind an actual wheel so it opens up huge possibilities for stock market board game. We’ve researched a few of the best stock market board games

Moving from beginner to expert in day trading or investing takes time. It also takes some knowledge of stock market 101. Without this knowledge of stock market 101 you can end up lost at sea for years. Worse, you could sink without understanding these fundamentals so let’s dive into the basics so that you can raise your game and increase your odds of stock market success. Stock Market 101 – Where the Trading Takes Place There are three main stock market indexes that beginners need to be aware of. These are the Dow Jones Industrial Average which tracks 30 different