Momentum trading strategies are employed by traders who believe in the saying “the trend is your friend.” This contrasts mean reversion traders who believe that prices revert to a historical mean. Momentum traders rely on a strong trend in either direction and above average volume. Some stocks are referred to as “momentum names” because they are historically large movers. Once a stock garners this designation; it becomes a self-fulfilling prophecy. The stock will attract more momentum traders hoping to profit from a sustained move in either direction.

Many times, these names are companies with a new product, or an innovative company which investors are unsure of how to value. This can create a wide array of opinions which will create outsized moves. Momentum traders do not have to be correct in analyzing the value of the company, only that the stock will continue its direction long enough to profit. This article will aim to discuss the pros and cons of momentum trading, momentum trading strategies, and offer insight to determine if momentum trading is right for the reader.

What Creates Momentum Trading Setups?

Momentum traders must first have some sort of news or price action that creates a buzz about a certain stock. Sometimes, price movement alone will create the news about the stock. Put another way, a company does not necessarily need to issue a press release or earnings; an abnormal move without news can draw in momentum traders. Depending on one’s strategy you may wait for confirmed corporate news, or an analyst opinion before attempting to develop a specific game plan.

Volume is a very large aspect of momentum trading strategies. Without a high level of participation, a move can run out of steam. This creates whipsaws or directionless movement.Traders identify momentum setups by scanning for breaking news or large relative volume increases. Imagine the case where some regulation changes how a specific industry is valued. In this case, a trader’s momentum trading strategy could be to look for the most liquid names in the sector to trade, for example. Another strategy could be to look for stocks in the newly valued sector with the largest ATR (average true range). This way, a trader can use a smaller position to potentially capture a very large move.

What Does A Momentum Trading Setup Look Like?

An important aspect of momentum trading strategies is they are largely uncorrelated to the market. In other words, these stocks have real volume flow because players are moving the price. The market as a whole should not affect the stock primarily. Predicting market moves over the short term is a losing strategy. Conversely, momentum setups are logical trades and have order flow independent of market moves.

A trader should first find stocks with a strong trend in either direction. Next, identify stocks that have been doing abnormal volume over the past month, week, day, or minute, depending on the momentum trader’s specific time horizon.

Once a trader finds a setup, he must define risk. A trader can use a variety of trade management techniques, largely dependent on each trader’s risk tolerance, account size, or time horizon.

Specific Momentum Trading Strategies

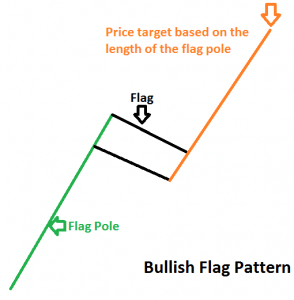

Next, we will discuss specific momentum trading strategies, and how traders can use them to profit. The bull flag setup is a bullish continuation pattern where stocks in strong uptrends consolidate for some time (months, weeks, days, minutes) and then continue their move higher to a target or a measured move. Shown below is a simple picture of bull flag continuation.

The stock will make higher highs and higher lows, then make a series of lower highs and lower lows. It is important that price stay above the low of the pole. After this sequence, it will break to new highs, ideally on abnormal volume. The tighter the range of the consolidation, the more powerful the move should be. The target is based on the initial up move, and the depth of the flag pullback. Entry on this setup takes place when the stock starts moving higher, breaking to new highs. Aggressive traders try to initiate a position while price is still inside the flag. Traders define risk to the bottom of the flag.

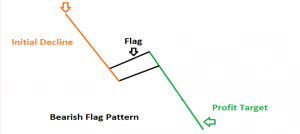

Opposite of the bull flag is the bear flag, which is a bearish continuation pattern. A stock will be making a series of lower highs and lower lows, consolidate for a time period, then break to new lows. The pattern should complete at a measured move. An example of this bearish momentum strategy is shown below.

The tighter the consolidation, the more powerful the move should be. The move lower should happen on abnormal volume for extra confirmation. Entry takes place when the stock moves to new lows, although some aggressive traders may try to initiate a position while still inside the flag. Regardless of your entry choice, risk can easily be defined to the highs of the flag.

Can Traders Profit From Momentum Trading Strategies?

Using examples listed in this article, traders should continue to scan the market for momentum trading setups. These setups tend to work because traders are on the right side of the trend, which is a profitable strategy. The goal of momentum trading is to capture the “meat of the move,” or the majority of the stock move. Successful traders do not sell the exact high or buy the exact low. Instead, traders seek favorable risk reward opportunities that repeat over time.

The size of flags tells a trader what type of risk/reward each setup offers. Momentum traders must keep in mind that volume as well as price action is vital to profitable setups. If participation wanes during a move, a trader should become skeptical of the move, as it may fail.