Online day trading exploded in popularity with commercial use of the internet. Traders no longer need a seat at the stock exchange or a direct line to brokers. Instead, individuals receive security quotes from the comfort of their living room. They are able to trade with others worldwide through various exchanges. Various software packages exist in the industry. We will discuss the best day trading platform options, and what makes them stand out.

Quotes are no longer available to only broker-dealers or market makers. Through direct market access (DMA), individual traders interact with the order book of an exchange. This levels the playing field for smaller participants. Additionally, it makes markets more efficient. DMA is available through a number of providers, each with their own pros and cons. Let’s take a deeper look at the best day trading platforms.

Best Trading Platforms For Active Investors

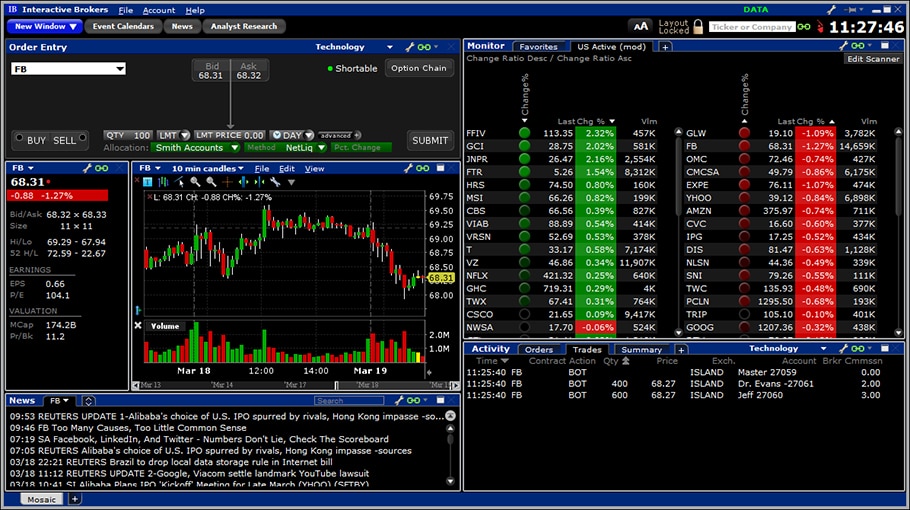

Interactive Brokers TWS is Interactive Brokers’ (IB) software used to trade securities. Market participants must have an account at IB in order to access this platform. It is a smooth running software and easy to learn. Furthermore, it looks clean and modern, allowing traders to remain focused. Looking at basic analog text wears on traders over time. Below is an example of a TWS layout.

courtesy : IB

This platform provides incredible stock analysis tools. Traders calculate their stock position profit in real time. Additionally, it offers custom scanning tools for active traders. It is important that traders do not miss profit opportunity. These scanning tools help capture maximum returns for traders. Opening an account at IB requires a minimum cash outlay of $10,000. However, those who are able to use this platform find it easy and efficient.

ThinkOrSwim (TOS) by TD Ameritrade is a newer platform that is now widely used. This newcomer caters toward options traders. However, equity traders take advantage of the powerful charting tools as well. TOS allows traders to seamlessly move from futures charts to options charts to stock charts without hassle. This platform also has a real time stock calculator for profits/losses on all positions.

Most noteworthy, this best day trading platform has an “on demand” feature. It allows users to go back and watch the trading action develop just as it did during the session. Think instant replay for stocks. It is an incredible platform for analysis and trading alike.

Best Prop Style Day Trading Platforms

Prop Trading is hedge fund style trading with many more trades and typically shorter time frames. These funds do a large part of the stock markets total daily volume. The traders are essential to market liquidity. Due to their volume, it is imperative that they route efficiently. Therefore, they require different style day trading platforms.

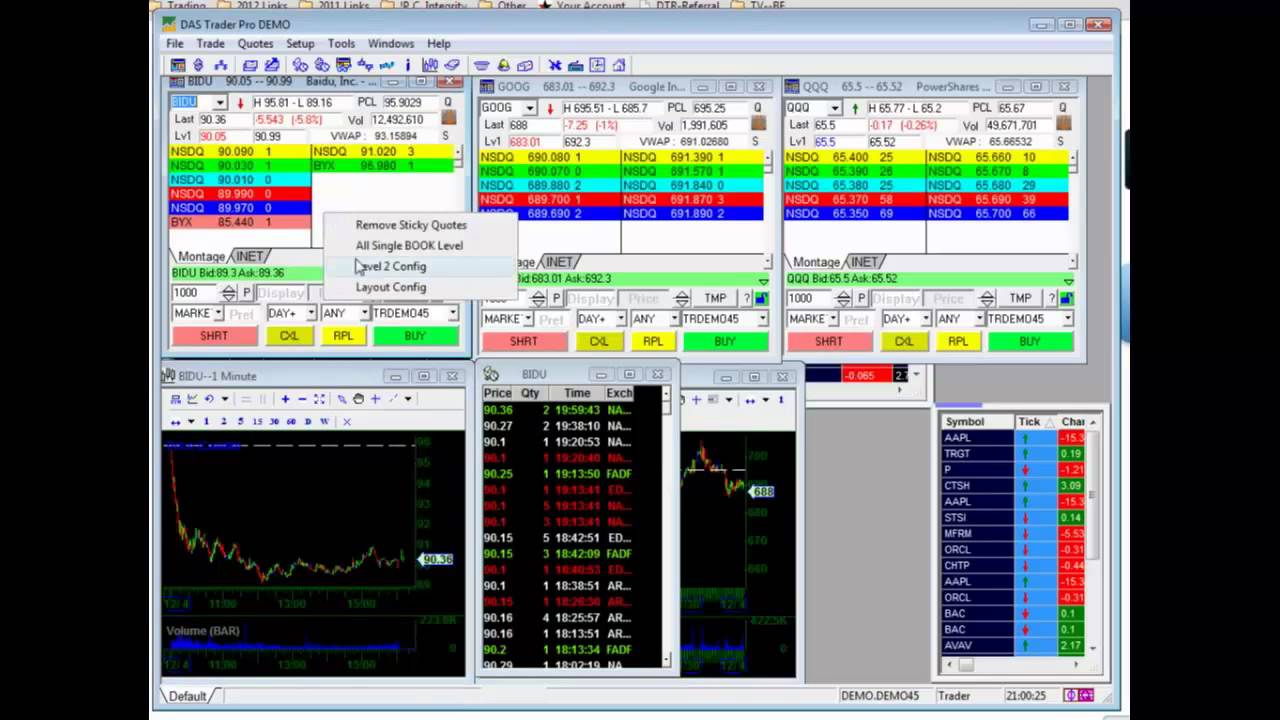

Das Trader Pro by Das Inc. is a prop style platform. This simply means more emphasis lies in the level II rather than charting or indicators. In prop trading, reading the tape is vital. Additionally, order speed is how traders profit from this information. You will notice the many different order options in Das Trader. Successful traders utilize these windows swiftly while spreading orders, or reversing positions.

courtesy: Youtube.com

Furthermore, it is important that a trader understands her edge. If she is a tape reader, she needs a day trading platform that emphasizes such information. Conversely, if she is a chartist, it makes sense to emphasize drawing and analysis.

Lightspeed Trading offers prop style routing with broker type looks. Like Das Trader, they cater to day traders and focus on speed and execution quality. Conversely, Lightspeed will execute trades directly. The company employs brokers that charge commission. Being a broker, this best day trading platform also offers margin. This is a more “all in one” type of platform.

Additionally, this platform offers an API for developing algorithmic strategies. It is likely not as developed as TWS API, but only basic code is needed to execute these strategies. Traders who understand algorithmic models stand to profit more than those who do not.

Why Not Have Both?

Platforms such as Das Trader allow one to use Das’ platform, but IB as a broker. A trader pays IB commission which are boasted as the cheapest in the industry for those who trade volume. Furthermore, he enjoys the order control of prop style Das platform. Lightspeed may offer similar services, but trading with a seasoned broker is important.

Occasionally, small cap, low float companies become active. This causes a feeding frenzy of plays to change their position or get a piece of the action. Eventually, interest wanes and bagholders are left long the name. When shorts see that buying interest vanished, they sell stock. These scenarios present lucrative trades. However, if a broker cannot provide a stock locate, the trade will not be able to trade it. He sits on the sideline while others profit.

In conclusion, the aforementioned scenario does not happen every day. Though, it does stress the importance of having the correct day trading platform. Trading is a game of large wins and small losses. If a trader does not have the right tools, he could miss a trade that otherwise made his year.

Final Thoughts

Many of these best day trading platforms offer trial periods. It is wise to use them and get to know their strengths and weaknesses personally. Trading as a career must be taken seriously in all aspects. Forums exist online where real traders offer first hand accounts of the products. A trader must understand their vehicle at all costs.

When traders grow their accounts into a sizable sum, a few firms are willing to negotiate commissions. In trading, all fees are important. There is only one source of revenue in this business, but many costs. E-Trade Pro is used by a great number of larger traders. It is not widely talked about day trading platform, which is not to say it is flawed. It offers more sophisticated analysis and tools.

In conclusion, data fees vary between platforms. As discussed, fees are an important aspect of the business. A trader must be willing to pay for necessary fees. However, he must be sharp enough to recognize irrelevant fees as they constantly plague traders.