Investors gravitate toward so called “blue chip companies” because they are typically household names. These are the biggest companies in the market, and with that comes an aspect of safety. What makes one blue chip pick different from the next?

Blue chips are typically dividend payers, giving them extra allure over pure speculative plays. These companies show a market capitalization of over $5 billion. With large caps leading this market to all time highs, it is important that market participants have concrete understanding of the space. A more in-depth explanation is found here.

Blue Chip Index

Most blue chip picks can be found in the Dow Jones Industrial Average (DJIA). The index is price weighted, giving higher priced stocks more weight. The index typically excludes high flying momentum names such as Amazon (NASDAQ : AMZN) or Facebook (NASDAQ : FB). This does not mean blue chip investing lacks diversity. Blue chips cover a variety of sectors, ranging from pharmaceuticals to financials, as discussed below. When we define blue chip, it does not imply old or dated companies.

Energy And Manufacturing Blue Chips

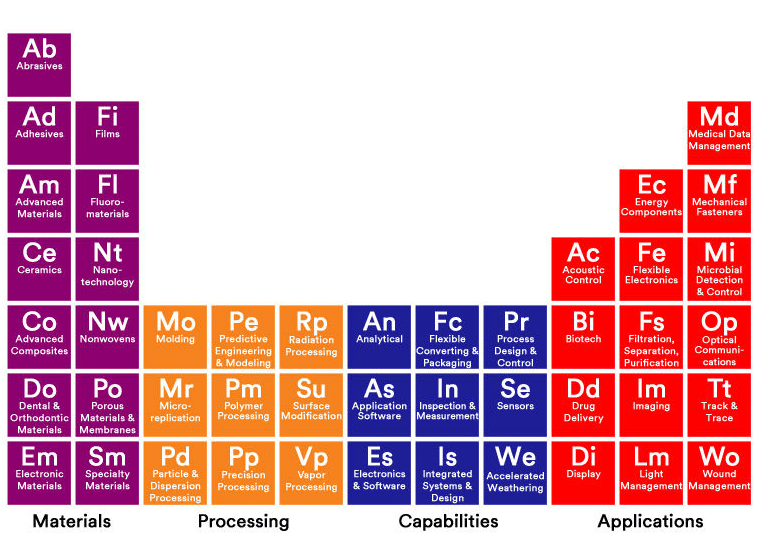

3M Company (NYSE : MMM) operates as a diversified technology company worldwide. Everyday investors know this company through products such as Scotch Tape and Filtrete air filters. The company dates back to 1902, and became a major supplier of parts to other blue chip stocks. For example, vehicles and large machine makers need air filters as well and they look to 3M to fill the demand. Shown below is an infographic detailing areas that the company services.

source: 3M

This blue chip picks shows a healthy dividend of over 2% and stable trading volume of over 2 million shares per day. MMM rewarded shareholders showing gains of almost 30% in a year period. The company continues to innovate, recently teaming with Minnesota Department of Transportation on autonomous driving projects. A cash rich company that continues to develop new products makes this company a top blue chip stock.

Chevron Corportation (NYSE : CVX) engages in integrated energy, chemicals, and petroleum operations worldwide. This is another blue chip stock that has deep roots, as it was founded in 1879. Furthermore, it has thrived through many different crude oil and natural gas cycles. The company shows a PEG ratio of under .5, showing that it still has room to grow into its valuation. Growth is important in this market, as investors seek out companies that are considered cheap.

The firm continues to innovate, especially in the age of alternative energy solutions. They developed fiber optic technologies that monitor in-well activity, making it safer and cheaper to maintain assets. CVX has always been on the cutting edge of projects such as horizontal drilling and 3-D seismic testing for oil wells.

Best Tech Blue Chip Picks

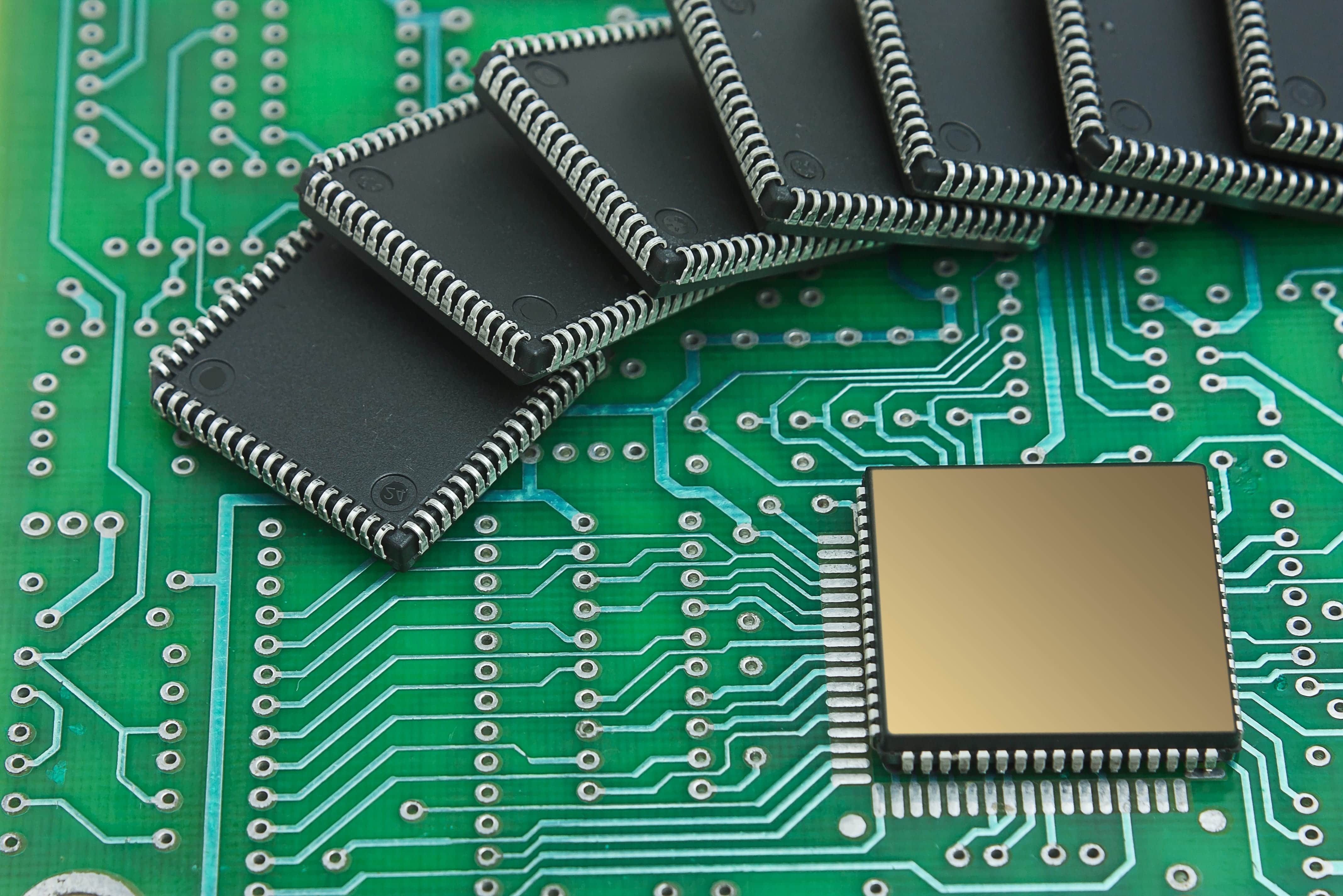

Intel Corportation (NASDAQ : INTC) designs, manufactures, and sells computer, networking, and communications platforms worldwide. The firm was founded in 1968- it was here before the internet boom and continues thriving long after the crash of 2000.

This semiconductor maker offers a rare dividend of over 2.5%. Additionally, the company shows a price-to-earnings ratio (P/E) of just over 20. This metric is used to value companies relative to its peers. For example, another chip maker in the space, NVDA, shows a P/E of over 40. Investors see INTC as a discount to NVDA, and consider it a value buy.

The company makes the processors that so many machines rely on. Furthermore, this blue chip pick is spearheading the move into virtual reality (VR). INTC has is now bringing VR NBA games to consumers- a multiyear project that will bring new revenue streams.

International Business Machines Corporation (NYSE : IBM) provides information technology (IT) products and services worldwide. It includes a Cognitive Solutions segment that includes Watson. Watson interacts in natural language and processes large amounts of data from which is learns.

Until recently this company struggled to grow the top line. IBM proved market demand for its products and investors noticed. The stock shows almost 60% institutional ownership, solidifying its place as a top Blue Chip pick. Furthermore, the stock gives a 4% dividend, making it one of the highest in the space.

Top Pharmaceutical Blue Chip Picks

Some investors shy aware from pharmaceutical companies due to their volatile nature. However, this is not always the case. Unlike a speculative biotech, these blue chip names will not lose a majority of their market cap because a single drug comes under fire.

Merk & Co., Inc. (NYSE : MRK) provides healthcare solutions worldwide. Some common diseases this company provides care for include type 2 diabetes and asthma. This a less risky drug maker because instead of relying on primary development for income, they will buy entire companies once the drug passes testing. It is this type of business acumen that has kept MRK as a top blue chip since 1891.

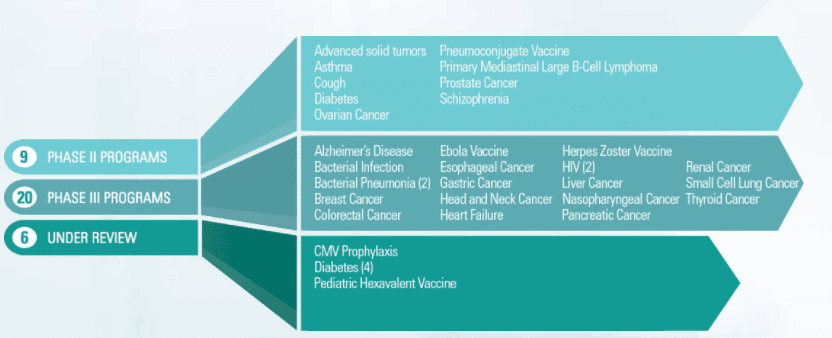

Investors look to the large analyst coverage provided in this name. Firms such as Bank of America Merrill Lynch, JP Morgan Securities, and Morgan Stanley offer opinions on the stock. Additionally, the firm offers a dividend just shy of 4% which is high for any company, let alone a pharmaceutical. MRK takes its research pipeline seriously, dedicating many resources toward new products and cures constantly. Shown below is the flow of the company’s pipeline.

source: MRK

Pfizer Inc. (NYSE : PFE) develops, manufactures, and sells healthcare products worldwide. Despite operating in the same space, this company has teamed with MRK on projects. This is a lower dollar name compared to some other blue chip stocks. Low price in addition to heavy trading volume allows investors to buy and sell stock freely without adverse trading fills.

Additionally, this name shows a dividend of 4% and a P/E ratio of under 10. Finding a blue chip name with such a low valuation is rare in this market. PFE shows over 75% gross margins on its sales. This name is not only a low risk pharmaceutical play, it has the makings of true value investment.

Final Thoughts

These blue chip stock picks boast proven records of excellence, in business and in stock returns. Despite varied sectors, these names provide consistent returns to investors over time. Interestingly enough, the blue chip universe has something for everyone. Some investors diversify holdings by purchasing a number of different names. Still others find edge in playing only one sectors. Whatever strategy a trader employs, blue chip stocks possess enough liquidity and information to provide healthy returns.