Moving from beginner to expert in day trading or investing takes time. It also takes some knowledge of stock market 101. Without this knowledge of stock market 101 you can end up lost at sea for years. Worse, you could sink without understanding these fundamentals so let’s dive into the basics so that you can raise your game and increase your odds of stock market success.

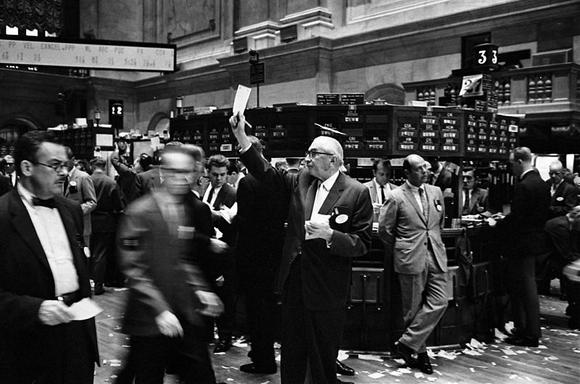

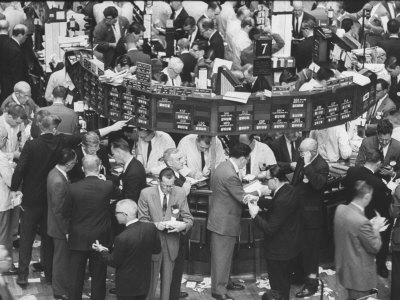

Stock Market 101 – Where the Trading Takes Place

There are three main stock market indexes that beginners need to be aware of. These are the Dow Jones Industrial Average which tracks 30 different blue chip companies. These companies are your household names: Disney, Nike, IBM, Home Depot and Coca-Cola are just a few of the 30 that make up this index. Next there’s the NASDAQ Composite. The NASDAQ tracks over 3000 companies, most of which are technology or growth companies. On this Index you’ll find Alphabet Inc., formerly Google Inc., as well as Apple and Facebook. The final of the big three is the S&P 500 which as the name suggests tracks 500 companies.

These three indexes comprise the cream of the crop; the companies that have been around for decades and which have racked many billions of dollars in revenue. By some estimate the total market capitalization for the three big indexes is a blistering $2T+.

No stock market 101 education would be complete if we didn’t touch on the Over the Counter Market (OTC). This market is still regulated by the overall governing body, the Securities and Exchange Commission (SEC), but unlike the big three, the listing rules are somewhat more relaxed. One big difference is the size of companies that can list on the OTC. No company trading under $1 can remain listed on the much-populated NASDAQ, but if you search the OTC you’ll find hundreds of companies that trade for less than $1. This valuation difference is hugely beneficial to companies that are just starting out. These companies, without the minimum capital requirements set by the larger indexes, are still able to raise capital from investors.

Stock Market 101 – Penny Stocks

Penny stocks don’t get talked about as much as they do the bigger stocks, but the reality is that for anyone interested in stock market 101, penny stocks are a very good option. Two things set them apart and make them ideal for beginners. The first is the accessibility of the penny stocks themselves. A typical penny stock that’s listed on the OTC will trade for around $0.10 – some can trade even lower, but this is a standard measure for most stocks. Penny stocks priced at these levels are very  accessible as compared to a stock like Apple (AAPL) which trades at $143.50 at this writing. The low price of penny stocks means that day traders can take advantage of multiple opportunities without needing a deep pocket.

accessible as compared to a stock like Apple (AAPL) which trades at $143.50 at this writing. The low price of penny stocks means that day traders can take advantage of multiple opportunities without needing a deep pocket.

The second factor that sets penny stocks and the OTC apart from blue chip stocks is the level of volatility inherent in each trading environment. Stocks that trade on the OTC are highly volatile which means that a single stock could move up 200% in a single session. Contrast this with a blue chip stock that hardly moves in value beyond say 5% and one can see why day traders are better served trading penny stocks on the OTC. Understanding these fundamentals of penny stocks and the OTC is a big step in grasping stock market 101.