Believe me, learning about options and related stock information can be very overwhelming…at first. In fact, before jumping into the various strategies, it’s important that you have a firm understanding on how options are priced. So, let’s get specific.

Stock options are priced using a mathematical model, the most famous being the Black-Scholes-Merton model. But don’t worry. The focus here will be on the determinants of an option value, not the math.

How to properly price an option

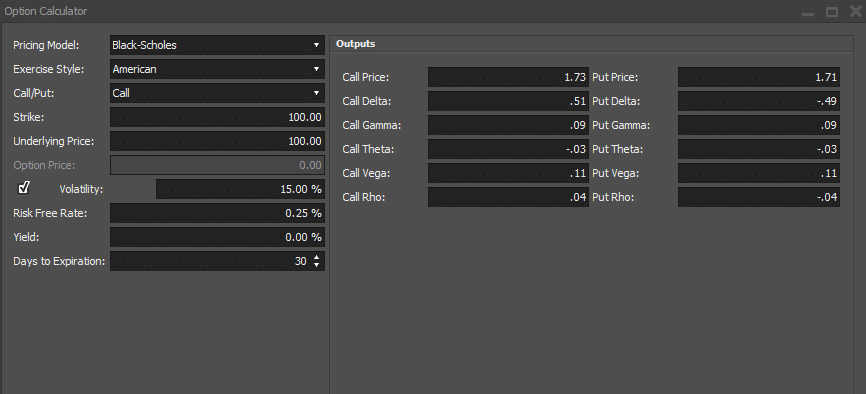

In order to properly price an option, one must know the current stock price, strike price, time to expiration, stock volatility, interest rates and cash dividends. Let’s look at some examples and see how these factors and stock information influence the price of an option.

Current Stock Price

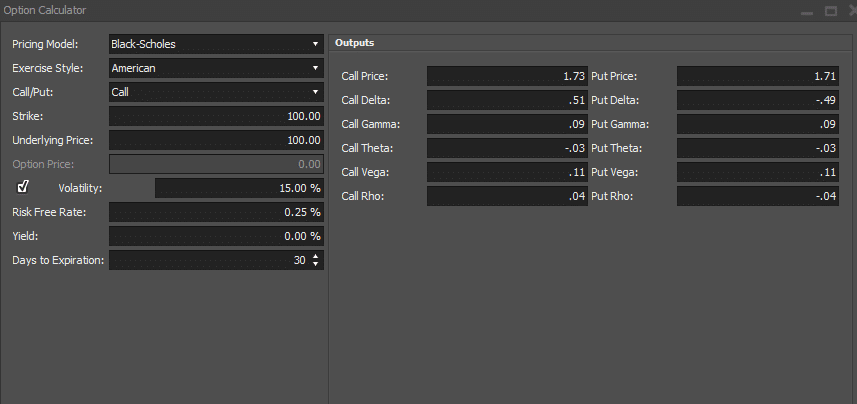

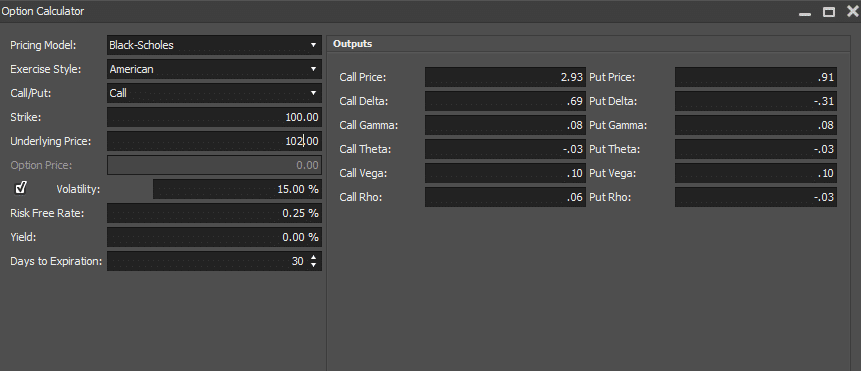

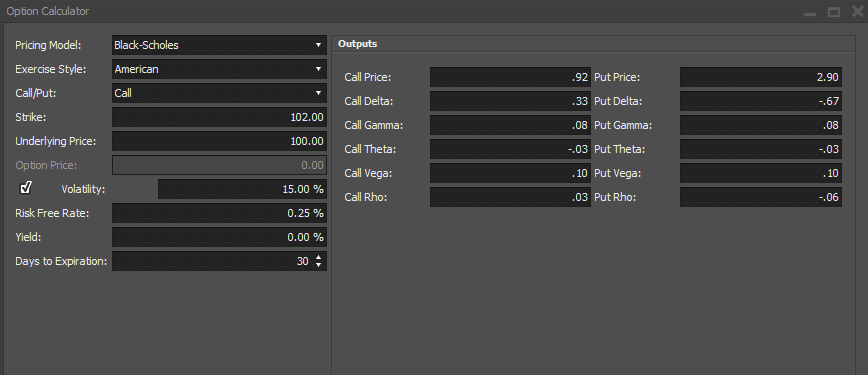

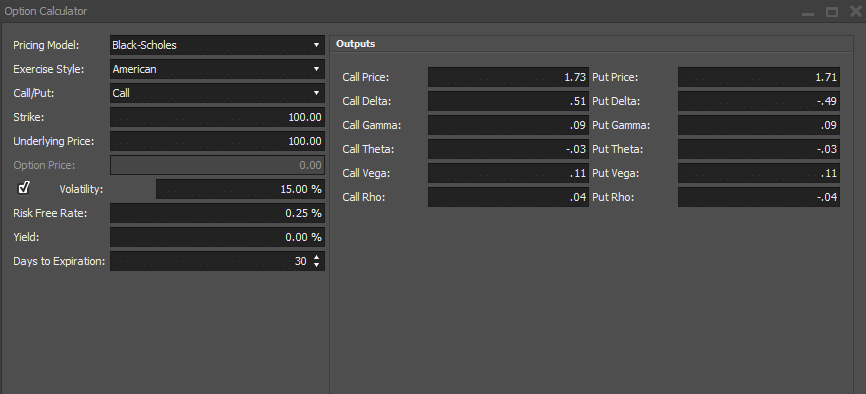

As the stock price rises, the value of a call should increase, the value of a put should decrease (all things being equal).

Notice that when the stock price rises 2 pts, from 100 to 102, the value of the call option increases, and the value of the put option decreases, as shown below. The call option value went from 1.73 to 2.93. The value of the put option went from 1.71 to .91.

Strike Price

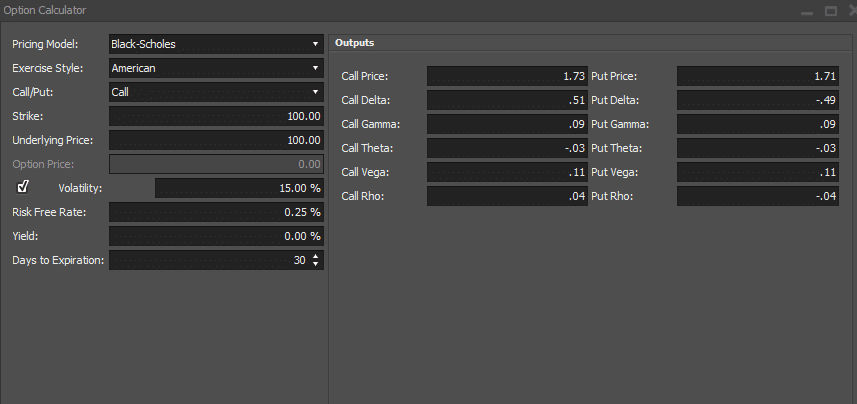

Options are often classified as OTM, ITM and ATM. An option built on stock information that has a strike price similar to the stock price is referred as ATM (at-the-money).

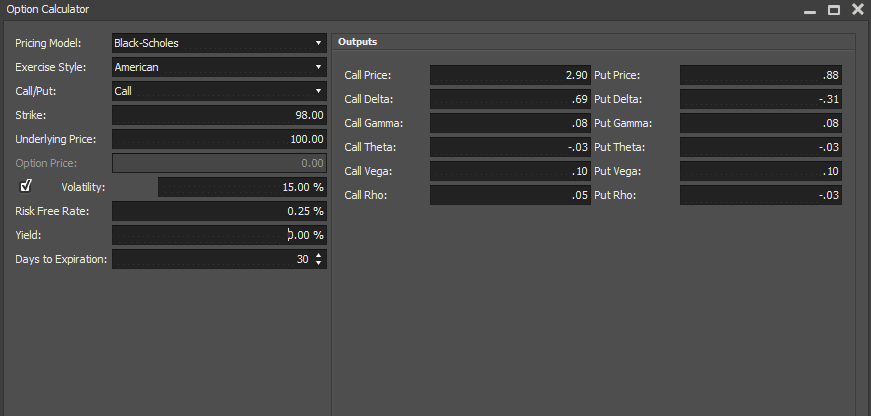

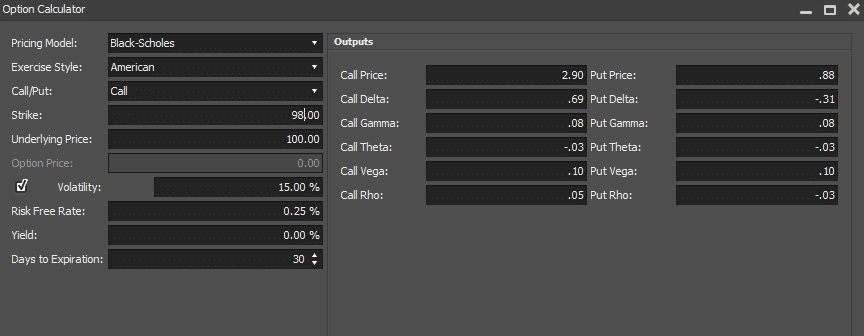

A call option that that has a strike price lower than the stock price is referred to as ITM (in-the-money).

An option that has a strike price farther away from the stock price is referred to as OTM (out-of-the-money).

For calls, the higher the strike price (OTM), the cheaper the options are. For puts, the higher the stock price, the more expensive the options are (ITM). For calls, the lower the strike price, the more expensive the options are (ITM). For puts, the lower the strike price, the cheaper the options are (OTM). For ATM options, the value of the call and put should be similar. If the probability of stock rising or falling is 50/50, this makes sense if you have stock information.

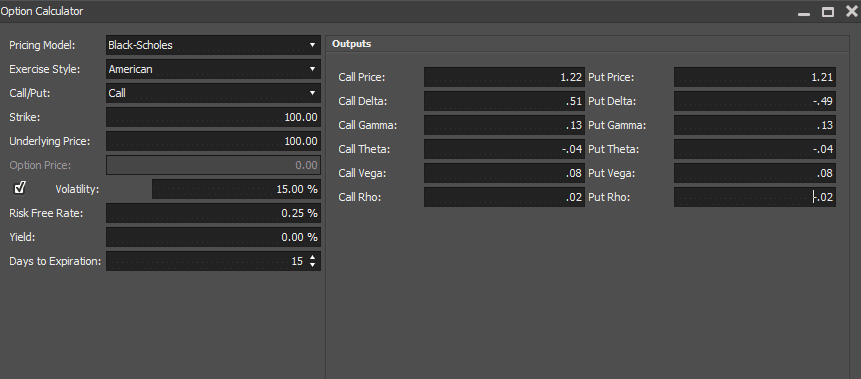

Time to Expiration

Options are said to be wasting assets. Think of the option pricing model as a probability model. The more time, the greater the value of the option, since we don’t know how high or low the stock price can go. The less time, the lower the value of the option will be.

At the end, the option will either close ITM or expire worthless. Options that are ITM, have a combination of intrinsic value and extrinsic value.

An Example

The 98 call has a value of 2.90. Hypothetically, if today was expiration, the options would worth 2 (intrinsic value). However, since there is 30 days remaining on this contract, there is .90 of extrinsic value added. Remember, at expiration, the only thing remaining is the intrinsic value.

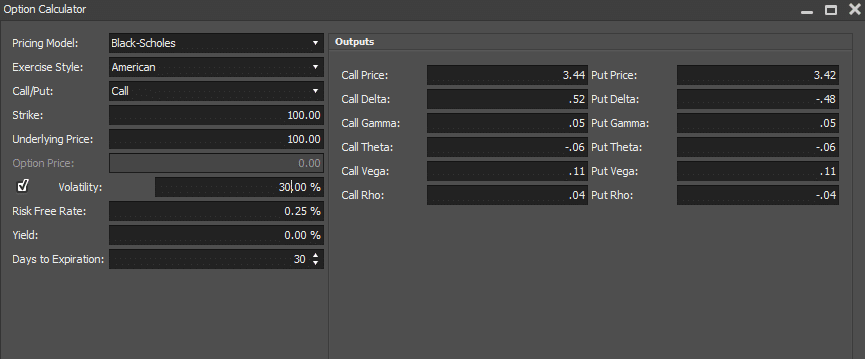

Stock Volatility

The higher the volatility, the more expensive options are – that’s the power of stock information. This goes for both calls and puts. The lower the volatility, the cheaper the options are. Higher volatility, gives the options more extrinsic value, lower volatility gives the options less extrinsic value.

Interest Rates

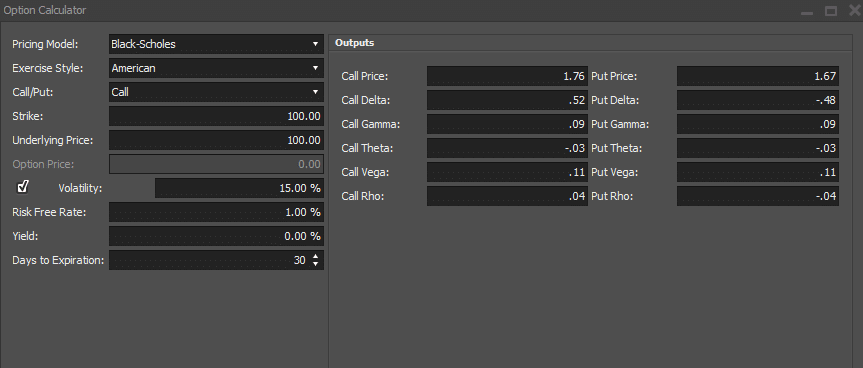

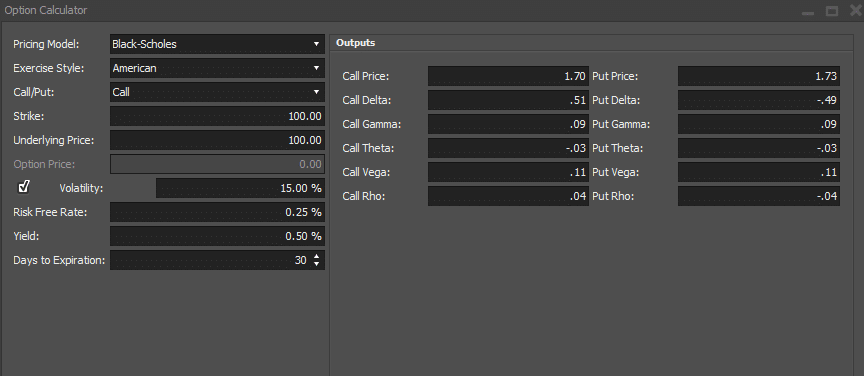

Now, we’ve been in a low interest rate environment for a long time. This factor is not as important for most traders, unless they are trading long dated option contracts. As interest rates rise, the value of put options decrease and the value of call options increase.

Cash Dividends

Again, this factor is not as important the first four discussed. However, it’s still useful to understand how it works.

As cash dividends increase, the value of a put option increases and the value of a call option decreases.

Conclusion

We looked at the various determinants of an option value. For anyone new to options, I’d recommend you play around with an options calculator to get a better feel for what influences the price of an options contract. After you’ve mastered this, you can then focus on more advanced topics like the Option Greeks and the various option strategies using stock information.