Solar penny stocks could be very hot in 2018 thanks to a few developments stateside and a resurgent market. Many day traders have managed to secure huge upside from some of the companies that have gone big and the truth is many believe that more will do so. Should you play aggressive with these solar penny stocks? Or should you wait and see? We say, go big or go home where solar penny stocks are concerned and we’ll outline our position.

Solar Penny Stocks – Industry Outlook

No doubt you’ve got wind of the fact that the world is going green. Oil prices have not only tumbled, they’ve fallen and is clearly having a hard time getting up. In the place of this huge void, which incidentally was making a lot day traders a lot of money, has entered solar penny stocks. The industry for solar has been growing massively in recent years thanks to the ubiquity of the technology and the falling prices of solar panels. This has put some pressure on some companies, but based on our analysis, its only the companies that are poorly run that have suffered from the changing dynamics of the space.

A big thrust for the potential growth of the solar space is the moves that President Trump is expected to make in his first year or two in office. Already he’s promised to reduce corporation tax in order to stimulate private investment and the growth of the entrepreneurial spirit in the US. Many expect this to impact the solar industry which could see more aggressive spending from serious investors in the space. Elon Musk is also a huge wildcard. Pretty much anything he does get noticed and since he’s investing heavily in electric cars and batteries, any entry into the solar space could give the overall market a huge lift. So we know that solar is going to be big in 2018, but what are the companies to watch. Let’s take a look a few.

Solar Penny Stocks – 3 To Watch

Ascent Solar Technologies, Inc. (ASTI) is one of the companies we believe day traders interested in solar penny stocks should keep an eye on. The company makes flexible, lightweight CIGS modules allow for seamless integration of solar power into a limitless number of applications without the restrictions of conventional glass panels. We smell game-0changing solar technology here so we believe ASTI is worth keeping on the radar. It’s also not a bad solar penny stocks to actively trade in, either.

China Sunenergy Corp. (CSUN) is another company that is worth keeping on solar penny stocks radar. The company makes the claim to being a global high-tech company providing high-performance solar modules for reliable green power generation. Sounds solid based on what the solar market wants and traders and investors are well aware of CSUN’s upside. The stock has seen movement in recent sessions, suggesting that traders and investors are active in the stock. Given the outlook for solar in general, this is definitely one for your radar.

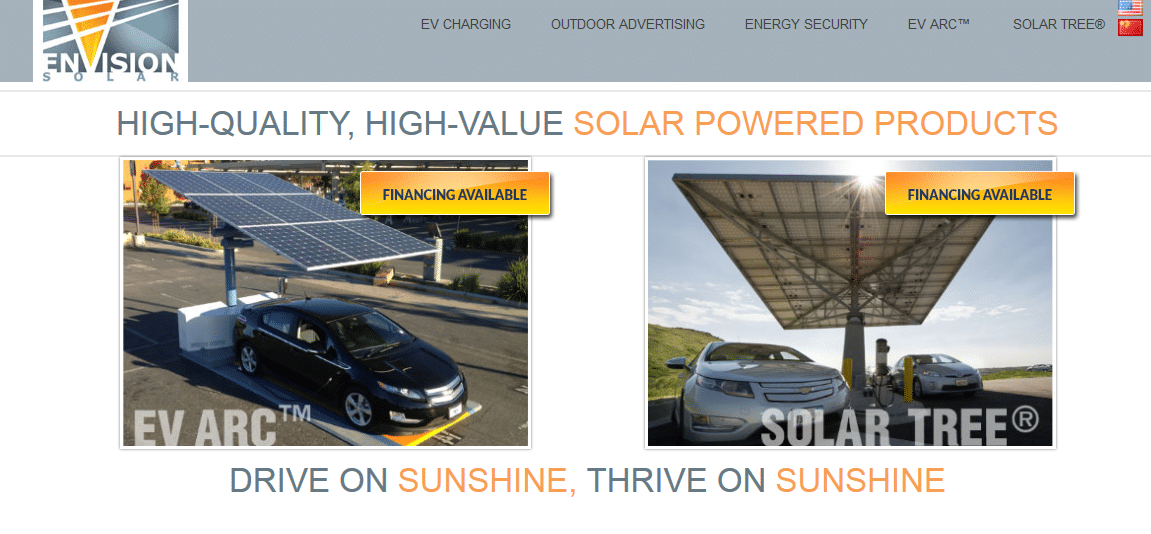

The last of the three we believe you should stock on your list of solar penny stocks is Envision Solar International (EVSI). This solar penny stocks trade slightly better than the other two and is very active among traders. The company makes a broad range of solar products; including solar powered charging stations for electric cars (this is huge!). In terms of growth potential you can see in a very plain way why traders and investors have started to pay attention to EVSI.

These three are just a taste of the sort of solar penny stocks that are out there. Indeed, you should try and load up on more than just three – we think at least 10. Where do you find more? You can take a look here – from time to time some of the best companies in the solar penny stocks space are discovered and delivered for free to subscribers.