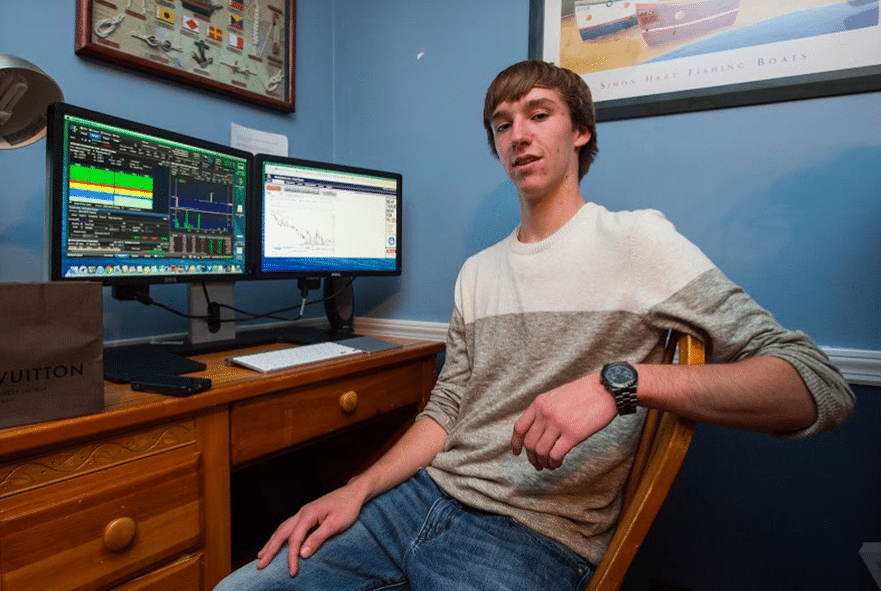

Do you want to make lots of money trading penny stocks in the shortest amount of time possible? Of course you do…I mean who wouldn’t? Everyone wants to take a little bit of money and make it into something substantial.

Now, there is nothing wrong with having lofty goals. In fact, setting goals for ourselves is a great way to stay focused and motivated. However, you’ve got to be realistic…and you’ve got to be smart about building up your trading account.

The Mind Set When Trading Penny Stocks

Think of the money you deposit in your account as it’s already gone. This is money that you can afford to lose…money that you don’t need to survive, pay the bills…it’s your fun money or play money. If you flushed this money down the toilet…it would cause no damage to your lifestyle.

Why is this so important?

You always want to be in control and focused on the trading penny stocks opportunities in front of you…without the pressure of trying to make something happen.

Sorry folks, but that’s the way it is.

Bankroll – Trading Penny Stocks

Second, you’ve got to put yourself in a position to be successful. How do you achieve that? It’s simple really. When you start you’ll need to give yourself margin for error. After all, not every trade is going to be a winner…you might have several losses in a row…you’ll need to have enough capital in your account to absorb losses.

Let’s say you open an account for $5,000 and the maximum risk per trade is $250. A $250 loss is equivalent to 5% of your entire account size. In addition, it would take 20 straight losses for you to go bust.

Ideally, you don’t want to risk more than 2% of your account size on one trade. By

Again, by trading penny stocks in this fashion you know that there is not one single day that will break your account. Also, it helps you focus on the bigger picture and getting out of the gambler’s mentality. It’s important to keep your eyes on the process of trading…making money is the end result of having a successful process. Always put your process first and the money will eventually start pouring in.

Building Your Stack – Trading Penny Stocks

As your account size grows, so should the size of your trades. For example, let’s say you took your account from $5,000 to $6,000 in six months. You should be increasing your share size, while still keeping relative risk at the same percentage. You see, by compounding your gains…you’ll eventually get to a point where you are trading some serious size.

This is the natural process. Of course, everyone wants to make money quickly…but you’ve got to be realistic if you want to take this seriously… and give yourself a real chance of making big money trading penny stocks.