Literature on trading is plentiful, but that does not mean it is all worthwhile. A good portion of it is created only for profit and lacks sound advice to help develop traders. This article breaks down the best day trading books and offers highlights of their strengths.

Characteristics of best day trading books include strategy development, psychology lessons, and personal takes on trading the markets. Successful trading depends heavily on finding a strategy that fits ones psychology. A trader needs to research different methods and understand which suits him best.

Best Introduction Day Trading Books

A Beginner’s Guide To Day Trading Online by Toni Turner gives new traders realistic expectations for the career. The book details time lines, start up costs, and even trading strategies. It was written when internet retail trading was just becoming popular. For that reason, it offers pros and cons of trading alone at one’s home.

This book is an upbeat introduction into day trading as a career. It gives priceless perspective on how to handle the ups and downs of a trading session. Whether a trader is new or seasoned, he must always remain calm and focused. The commentary is given from a real life successful trader making it invaluable.

How To Day Trade Stocks For Profit by Harvey Walsh details methods involving the creation of a trading plan. Every successful coach, general, or businessperson has a plan of operation. Trading is no different. Some trader have a black box trading method in which they never deviate from a plan. Conversely, others allow themselves flexible plans and rely more on gut instinct for trade decisions.

This author gives exercises to hone skills and make the art of trading more precise. Additionally, it is given from the perspective of a trader. This way, traders understand what the successful trader was thinking and feeling during the trade. This book will help with trader development in an active way, as it guides readers through the exercises and trade stories.

Best Interview Day Trading Books

The follow selections use interview format with some of the worlds most successful traders. They offer rare perspective on what made these individuals so successful. The interviewer does a phenomenal job getting the best advice from these typically reclusive people.

Market Wizards by Jack D. Schwager did the trading world a favor when he set out to interview the top traders. It is no wonder this is a must-read for anyone participating in financial markets. This is the first collection of so many titans of industry offering advice in their chosen field.

Furthermore, this chronicling reveals that these individuals are not immune to mistakes. Paul T. Jones remembers losing his first large sum of money being a very necessary and helpful step in his journey of success. Each of these traders give unique nuggets of information that help traders shorten the learning curve.

Reminiscences of a Stock Operator by Edwin Lefevre is a biography of early 1900s trader Jesse Livermore. However, the names in the book are all fictional, as Livermore did not seek the spotlight. This is the first and clearest view of speculation as a career. The protagonist shares his journey from poor farm boy to rich playboy to flat broke. It is a calm memoir of the reality of being paid by the stock market.

Many fund managers require their traders to read this book. Livermore used an actual strategy that he developed. Many believe that Wall Street was run by rumors and tips. However, he defied these rumors, relying on tape reading for profit. He ran a lonesome business, eventually using an office away from the stock exchange. The book solidified itself as on the best day trading books.

Best Technical Day Trading Books

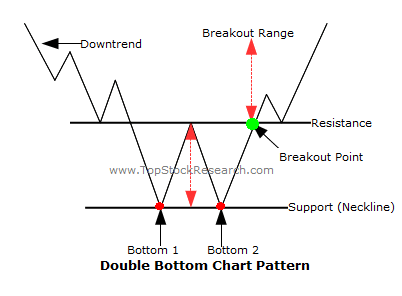

Technical analysts believe that price patterns repeat over time, creating profitable trades for those who identify them. Many books exist detailing these patterns, some even offer trade management tactics.

Technical Analysis of Stock Trends by Edwards and Magee dates back to the late 40s. The time period is irrelevant as speculators still use these theories today. It expanded since then, now showing 9 editions in print. The book shows real life chart examples of the patterns developing, created in a world before computers.

Additionally, fund managers and traders alike agree this work is a must read for any trader. It benefits day traders and position traders alike. Risk management is of the utmost importance in trading and this book gives sound management advice. It is very technical in nature, and is recommended as a reference asset for serious traders.

Encyclopedia of Chart Patterns by Thomas Bulkowski is a massive collection of chart patterns and statistics on those chart patterns. These statistics provide hard evidence on the risk/reward of each pattern setup. The author specifically mentions different time frames expect different results, but only in terms of magnitude and not necessarily performance.

In addition, the author provides a website for further research. The book and the website work together to provide traders with the most edge possible. It is an excellent way to learn chart patterns and their win expectancy, making it a best day trading book.

Final Thoughts

Trading is a lonely business, but this does not mean help is absent. Traders are always sharing ideas, theories, and strategies in order to grow and maximize profits. These best day trading books will help any trader in her journey. Profitable trading includes learning from past mistakes and not making them again. Traders in the books mentioned in this article share their mistakes in order to shorten the learning curve for others.

Traders never stop learning, making this profession very mentally demanding. These books assure traders that regardless of setbacks, one must remain calm and rely on strategy and discipline in order to succeed.