The more prepared you are as a trader, the better the chance you’ll be able to make swift decisions when the pressure is on trading good stocks to buy. One excellent way to be prepared is to have watch lists on hand. For example, let’s say there are negative comments on a specific pharmaceutical company, the stock price might react negatively, but it might also affect similar companies in that same niche. Imagine you had list of good stocks to buy in that specific sector and were ready to trade off the news vs. scrambling and thinking what other company will be affected by the sectors negative news.

On the other hand, let’s say the government just passed a law that will open up new projects and create greater business in the solar sector. Again, instead of scrambling to figure out which stocks are going to benefit, you have a list ready and are ready to fire off.

The previous examples focused on news events. However, you can create watch lists based on specific price levels as well. For example, let’s say XYZ is trading at $4.50, and you’d like to be a buyer at $4, a watch list and alert can be created to inform you when or if that price level is reached.

So how can you go about making a list when trading good stocks to buy?

Well, there are a number of free services available. With that said, here is an example of how to create one. In this example, we will use the website www.finviz.com

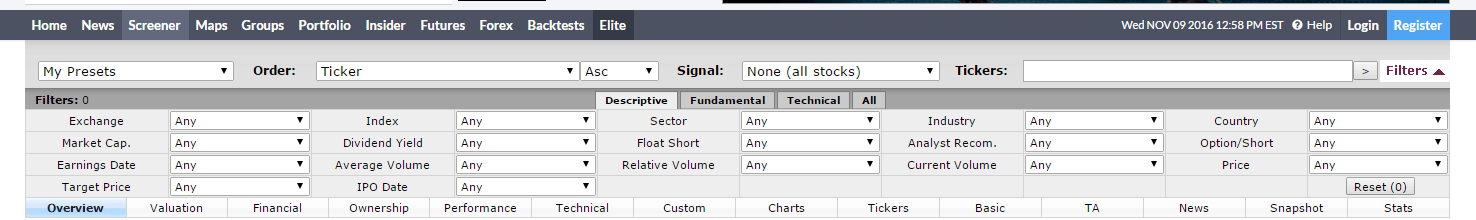

The screener tab allows us to select criteria for our list.

In this example, we selected stocks that are traded on the NYSE, with a market cap of over $50M in the healthcare sector. The stocks are in the biotech industry and have a short interest of over 10%.

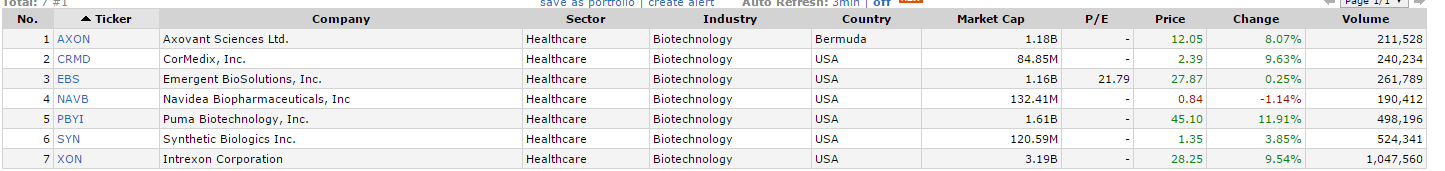

Below is a list of the good stocks to buy that matched our criteria.

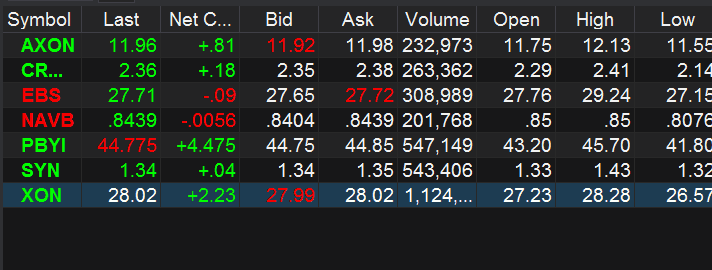

We can then take those names and put them on our watchlist in our trading platform.

Now, if something were to pop off then we’d be prepared to take action.

You can even use google finance to create a list as well. Let’s say we had an interest in clothing retailers. Maybe there is some upcoming economic news or holiday sales numbers about to be released.

We go to google finance and punch in the symbol for Abercrombie & Fitch Co. (ANF).

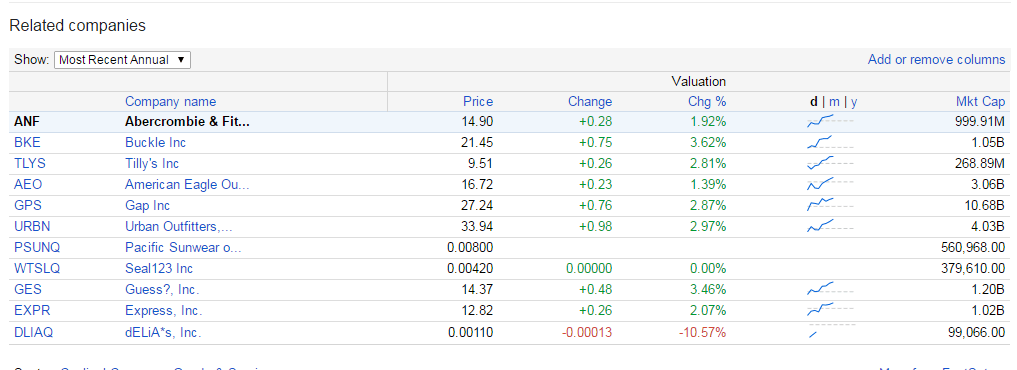

Below you’ll find a list of related companies:

Let’s say we found these names interesting and wanted to create a list in case something happens in the space.

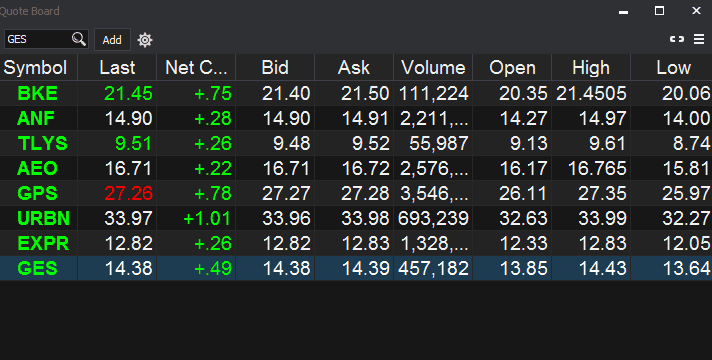

Our clothing retailers are on our trading platform and we’re ready to move if something happens. Depending on your trading platform, you can probably set price alerts if it hits levels that you find interesting.

Using your imagination, you can create lists for any type of market condition. For example, some traders have lists for commodity related stocks, high short-interest stocks, low-float stocks, sector specific…you name it.

The key takeaway is to be prepared. If you’re caught scrambling when markets start to get silly, then you’ll miss out on some potentially amazing opportunities when looking for good stocks to buy.